Table of Contents

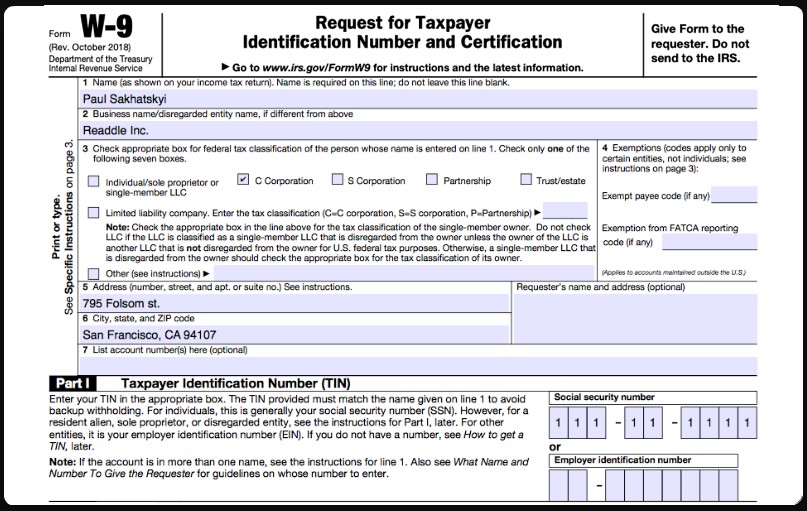

W9 Tax Form 2021 Printable – People who pay for a service from vendors and employers across the United States have a responsibility to the country. Each time they engage in business-based relations or hire staff, such as independent contractors or freelancers, they must generate a W9 form or document that’s also formally referred to as Request for Taxpayer Identification Number and Certification.

If you are included in the categories above, then you have to ask the contractor or employee to submit the form. It is intended so you get a record of their Taxpayer Identification Number or their Social Security Number (SSN). You don’t need to send the filled form back to IRS, though, instead keep it as documentation when you need to generate 1099 and W2 forms.

What is W9 Form 2021

As mentioned in the prior, W9 is a document used to collect the SSN or TIN of someone that engages in US-based business activity. It is filled by either individual or business units. If someone is not eligible for U.S TIN, they might use the W8 form (for foreign individuals or businesses) or W7 (for persons that obtain United States’ residents’ title for tax-related purposes)

W9 form requires you to gives personal information details such as personal name or business name, identity number regarding tax, which either filled by Employer Identification Number (EIN) or Social Security Number (SSN), signature to verify that the provided information is correct, and to confirm that the taxpayer indeed has legal US citizenship, the person who join venture in US-based businesses, or a resident alien.

What Should You Perform to Complete Form of W9

The instructions below will guide you to fill in each of the sections within the W9 form 2021. Follow the steps to complete the document correctly:

- Line one: Write down your full name as an individual on it, which matches with your name in other tax-related documents down to its spelling.

- Line two: This is an optional section. Fill this section only if your submitted name is different from what you put in the prior section. Write down your business name, whether it is its official name, trade name, entity name, or DBA name if there is any. The purpose of including these names is to help your clients identify your identity by a commonly known label.

- Line three: Choose your classification of United States federal tax by checking only one of the boxes. Keep in mind selecting the tax classification according to the submitted name in-line 1.

- Line four: Write down your tax exemption code in the first field if you receive backup withholding exemption, or write down your FATCA exemption code in the second field if you get relief from FATCA reporting.

- Line five: Write down your detailed address, which includes the residence number, apartment unit number, and street name correctly, because the form will be shipped to this address.

- Line six: Write down your state name, city name, and ZIP code accordingly.

- Line seven: This is an optional section. Write down your account number that’s given by the entity that requests you to submit the form.

- Next is also an optional section. Write down the full name and detailed address of the entity that requests W9 from you.

- Part one: Write down your Taxpayer Identification Number (TIN) here, by using either your Employer Identification Number (EIN) or Social Security Number (SSN).

- Part two: Certify the document by putting the date and your signature within the form. The process to fill out the W9 form is actually really easy and simple – it probably can be done in less than ten minutes. That being said, you have to double-check the form and make sure each of the inputted information is accurate.

W9 Tax Form 2021 Printable

Loading...

Loading...