Table of Contents

W9 Form 2021 Download – At some points, you might find yourself get requested to fill W9 form 2021 by a business you work for or by a financial institution. Before submitting this document, it’s better to understand what it is and what purpose it serves first, which you may read about in the helpful explanation below.

About W9 Form – What is a W9 Form 2021?

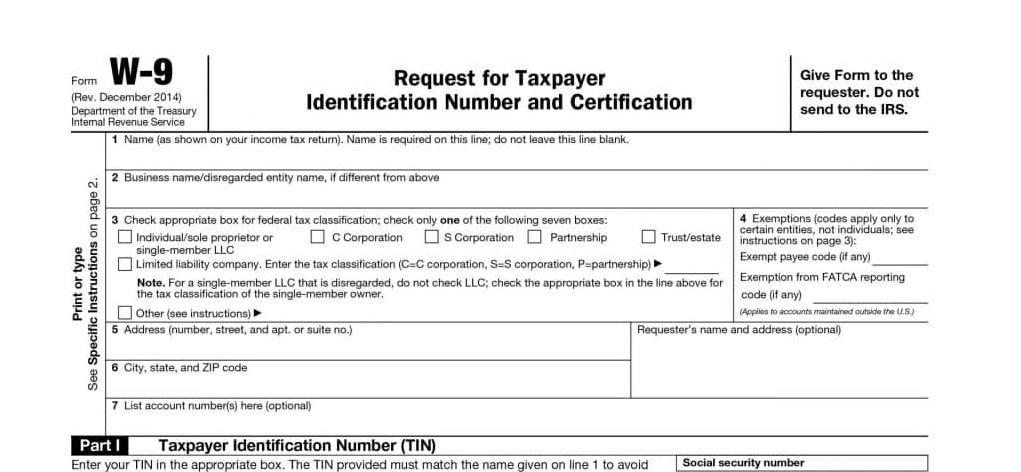

W9 form, or more officially known as Request for Taxpayer Identification Number and Certification, is a document issued by the US federal agency Internal Revenue Service (IRS). It is used to gather identity numbers from entities and individuals to take care of their taxes. This form doesn’t have to be sent to the IRS back, but to be kept as a record and documentation when requested by IRS, so your tax identification number can be noted down regarding your payments.

This document is actually simple and easy to fill out. Here are several information details needed to complete the form:

- Full name

- Name of the business if necessary

- Classification of your federal tax

- Details of address

- Identity number related to tax, and

- Signature

If you submit the form as an individual, then choose ‘individual’ as the classification of federal tax. On the other hand, if you submit it as a business entity, then you may choose between limited liability company (LLC), S corporation, C corporation, sole proprietorship, estate, trust, or partnership. Individuals fill their identity number by inputting their Individual Tax Identification Number (ITIN) or Social Security Number (SSN), meanwhile, business fills theirs by inputting Employer Identification Number (EIN).

Eligible Persons to Complete W9 Form

In order to fill and submit a W9 form, one must be registered as a US citizen and have been authorized to work within the country. It includes several types of associations, such as corporations or partnerships based in the US, as well as trusts and estates with domestic attributes.

In case you are not a citizen of the United States or you are not qualified to submit this particular form for certain reasons, then you should opt for the W8 form. It is a document that meant to be used for entities such as foreign businesses, estates, or trusts. Just like the W9 form, this document also requires you to provide your full name, address, and certification by using a signature – but there is more: you need to provide the county in which you receive or apply for service. This is meant to make sure that you pay to withhold tax from your income in the correct amount because the tax rate between your original country and the US might differ based on a tax treaty.

It is possible for some people to not be sure if they already get the legal status of a US citizen or yet to have. For example, for people with double citizenship, sometimes they aren’t sure if the citizenship from the United States is stilling old. Along the same line, they may not certainly sure if their business is considered a US-based entity.

If you find yourself facing one of these scenarios, you may want to consider reaching an expert or professional at tax subject to make sure of your status. Besides getting a better understanding of your citizenship and residency status related to the W9 form, it is also beneficial when you need to submit other types of tax-related documents.

If the business you work for or a financial form asks you to fill W9, you may ask to be sent the blank copy of the form – then you can print the document, fill the form manually, and then scan it to send electronically. As an alternative, you might get a copy of this form by asking tax professionals or even get it for free by downloading it from the internet page.

W9 Form 2021 Download

Loading...

Loading...