Table of Contents

How to Fill and Submit W9 Form As Self-Employer Worker – Besides working with employees (in the most conventional sense of the word), a lot of companies also work with freelancers and independent contractors. Although both of them have the different classification, companies are still required to report how much their individual payments are to Internal Revenue Service. W9 is a form that’s used to fill tax by using the independent workers’ personal information, including their full name, address, and TIN (Tax Identification Number).

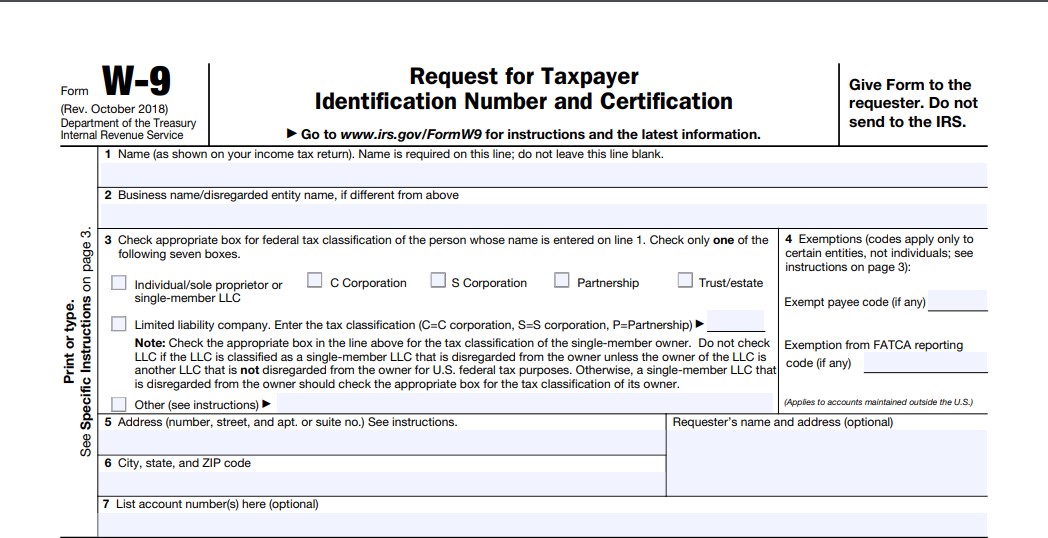

W9 Form 2021 Printable, Fillable & Blank

Being independent workers, freelancers, or self-employed have their own advantages and disadvantages. They have the ability to control their working schedule and free time, but it doesn’t mean that they are free from obligations. Report their earnings and submitting the tax documents are some of those obligations as a form of responsibility. They also still required being aware of rules and deadlines regarding tax, as well as organizing required paperwork by the IRS.

If you are working with a business company, the chance is, you are already requested to fill aW9 document during the retaining or invoicing process. The form is typically provided by the company, but if it’s not, it’s possible to download it yourself on the IRS website.

W9 Tax Form 2021 Printable

When you are hired by a certain company to work on short-term projects or on basis of freelance, you already have had the responsibility to fill out W9. Another case where you are classified as the candidate for this particular form is when your annual income exceeds $600. In some other cases, you may be asked to fill the document out in order to acquire secured property, report transactions of an estate, deciding payments of mortgage interests, and canceling debts. To remember when you must fill out the W9 form, you can create a calendar on Free Monthly Calendar Printable and Editable.

If you are someone who works professionally for more than one business of a company, the form will be necessary too. It is needed to check your employment status within the company and confirm that indeed you aren’t employed as a full-time worker, as full-time workers are obligated to submit the W4 form instead of W9.

What Is a W9 Form?

The W9 form is usually also referred to as the Request for Taxpayer Identification Number (TIN) and Certification document. It is a tax document that’s issued by Internal Revenue Service (IRS), and only contains a single page. The form contains important personal information that regulates the relationship between you as an employee and the company as the employers. It is typically submitted back to IRS with other required documents. This specific form is amongst the most used document to report tax in the United States. The document does not always have to be sent to the IRS.

What Is a W9 Form Used For?

As mentioned above, the W9 form is typically used when a business or company uses independent workers or contractor services. This is the reason why each self-employed worker (such as a freelancer, invited consultant, vendor, LLC contractor, or independent contractor) in the United States has to submit a W9 document to the company as the employer.

In return, the self-employed workers are required to fill and submit the form then send it to the employer who will keep the document for a few years. In technical terms, the document is used as confirmation that a recently hired employee is responsible for their own income-based tax and to cover Social Security and Medical Care.

It has been talked about in the prior section that you do not have to send the document back to the IRS. Instead, the form must be sent to the company or its human resources department that you are currently working with. The employer then will use the information provided within W9 to fill other documents related to a tax called Form 1099. Later on, it is used by the IRS to match your annual income tax and the earnings data from the company.

Inside the form, there are various details regarding the self-employed worker, including full name, business name, address, employer identification number, and social security number. You confirm that all the provided personal information inside the W9 form is correct by signing it, as well as certifying that your tax isn’t withheld by the employer.

This specific tax document is usually updated annually. However, under certain circumstances, it might be needed to be updated according to the change of your condition. For example, it might be reviewed back if the contact information or ID number to submit tax is changed – thus the W9 must be updated as well.

How to Fill Out a W9 Form?

The W9 form is relatively short, considering it’s only consisted of one page. It consists of two sections, with 7 lines in the first section and 2 parts in the second section then proceeded by fields for date and signature.

Here is the complete guide of filling out the first section in the form step by step:

- Line 1 provides a field for name. Input your full name and ensure that your name is spelled in the right way, as the spelling must be identical to your other tax-related forms.

- Line 2 provides a field for a business name. This part must be filled out only if you own a business, and its name (entity, DBA, and trade name) differs from what you input in line 1 of the document.

- Line 3 provides a field for tax classification. It indicates the status of your tax by using classification from the IRS. Check the box that’s available below based on your status – depends on whether you fill the document out as an individual, LLC, corporation, or partnership. You have to check one box only.

- Line 4 provides a field for exemptions. There are two lines in this part. Fill the first line by inputting your code if you are exempted from backup withholding. Meanwhile, fill the second line if you are exempted by the Foreign Account Tax Compliance Act (FATCA) to report. You don’t have to fill this part if you fill the document as an individual.

- Line 5 provides a field for address. Input your entire address in this part, including the street name and number of buildings or apartments so any notifications or returns of information could be sent directly to you.

- Line 6 provides the field for ZIP code, city, and state. Fill accordingly.

- Line 7 provides a field for ZIP account numbers. List your account numbers that are needed by the employer. It might be left blank if you do not have any.

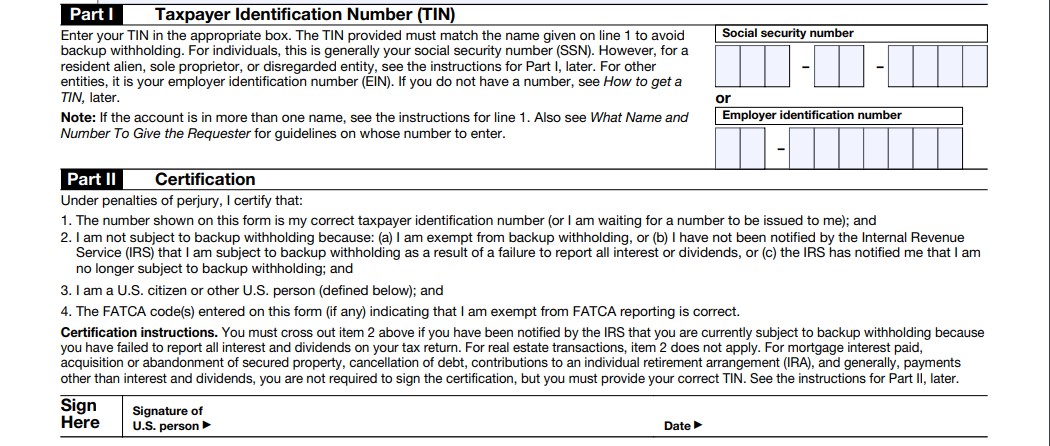

The second section inside the W9 document consists of important personal details that will be used to report your earnings paid by the employer. Fill it out by following the guide below:

- Input your Taxpayer Identification Number (TIN). There are two available options here. If you fill the document as an individual or one-member of LLC, input your Social Security Number. Meanwhile, if you fill the document as a partnership or corporation, input your Employment Identification Number. Both numbers might be filled if you are individual entrepreneurship or sole trader. TIN is allowed to be indicated if you are not eligible for Social Security Numbers.

- Certify the document. Last but certainly not least step to complete the W9 form is to confirm all the entered data to be correct. Double-check the document and revise any necessary part, then insert the date and sign the document in their respective fields.

FAQ (Frequently Asked Questions)

Where Can I Get a W9 Form?

Typically, the form will be provided by the company, business, or financial institutions because they require you to fill it out in the first place. If there some issues, and they won’t be able to provide it, the document is downloadable from the official website of the IRS. We provide the download links at the last of this article.

How do I Send a W9 Form?

There are three possible ways to do it. First, hand it off in person as the most practical and ideal way. Second, use secured methods of free online service such as encrypted e-mail or other file-sharing services. Third, send it through postal service, UPS, or FedEx.

How to Email a W9 Form?

As tax documents that you are about to send to a company, public accountant, or tax professional contains highly important information, make sure you only use e-mails service that provides encoded information and maximum level of protection.

What is a TIN Number on the W9 Form?

TIN stands for Taxpayer Identification Number. It is the ID number that’s used by IRS to managing and regulating tax laws. The number might be issued by the IRS itself or Social Security Administration (SSA).

Why do You Fill out a W9 Form?

The document is required to be filled for tax reporting and accounting purposes. It is not sent to IRS but to the employer or payer instead.

What is the Purpose of Filling Out a W9 Form?

The sole purpose of the W9 document is to confirm your Taxpayer Identification Number (TIN), because the number is required by your employer to file Form 1099 or other tax documents related to IRS.

Is a W9 the Same as a Tax-Exempt Form?

Both are different. The W9 form is issued by IRS and its purpose is to report tax by disclosing your identification number. Meanwhile, the tax-exempt form is issued by your state and its purpose is to confirm that the business you are in is not required to pay tax.

Who Needs to Fill Out a W9 Form?

Any self-employed workers such as consultants, independent contractors, or freelancers are required to submit this document. It’s also required for anyone who annually earns more than $600 without being under a business entity.

When to Fill a W9 Form?

The W9 form is required to be filled out when you are just hired by the company. It might be revised if there’s any change related to your information.

Do I Have to Pay Taxes on W9?

Generally, filing and paying tax is an obligation regardless of your income level and whether you are classified to submit a W9 document. As self-employed workers may not have paychecks that include taxes, then you owe income-based taxes throughout the year or at the end of the year to the state and federal.

Is a W9 Required by Law?

According to the law, the W9 form is only obligated to be submitted to an entity that gives you payment, compensation, dividends, or other kinds of reportable income. Legally, you aren’t required to provide the document without a valid reason.

Do You Have to Pay Taxes on W9?

The company or business entity doesn’t withhold your taxes by using W9. You are responsible to pay the correct amount of taxes to IRS on your own, along with the share of employer and employee for Medicare and Social Security taxes.

How Does a W9 Affect My Taxes?

The form helps you to input the newest information inside the document related to your tax information. It is your responsibility to pay the appropriate amount of taxes and claim your income of tax return.

What Happens If a W9 is Not Filled Out?

Failing in providing a W9 form may lead to getting penalties from IRS and tax departments in your state. For each violation of this particular tax regulation, you’d be penalized for $50. Your payment also will be withheld by 28% of your paycheck by the employer which then will be preceded forward to the IRS.

Can You Refuse to Sign W9?

Providing a W9 document is mandatory if your Taxpayer Identification Number is required by the employer. You will face a penalty if you or the employer fails to report the information accordingly to the IRS.

Conclusion

Filling out the W9 form as a part of tax payment is a crucial matter if you are a self-employed worker. The employer that you work for or with is not withholding your paycheck taxes. Therefore, this document serves as a form of agreement that you’d perform your own obligation to pay taxes.

Keep in mind the W9 form is not sent back to the IRS. It must be sent to the employer that has requested it for you to fill out. The document is quite simple. However, it must be filled correctly with accurate information. If you have any questions or confusion regarding the document, consider asking help from professional tax accountants.