Table of Contents

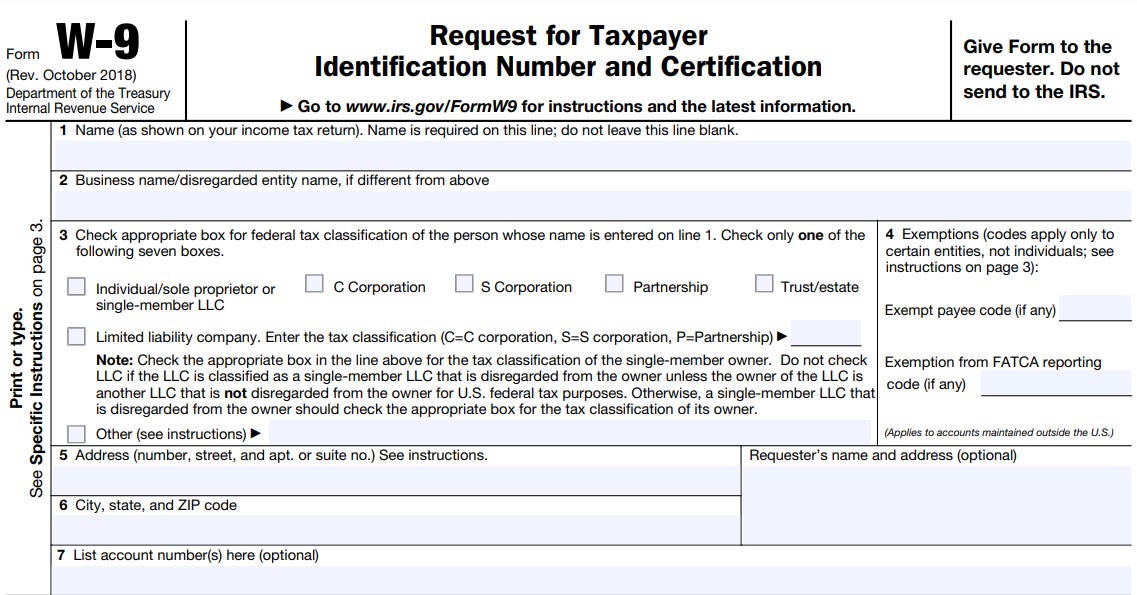

W9 Form 2021 – If you ever receive a request to fill and submit a W9 form, it means that the person or business that uses your service and pay for it needs your Taxpayer Identification Number (TIN) in order to notify Internal Revenue Service (IRS). There are various payment situations that use W9 but most often it is used when the business work with an independent contractor or freelancer agent.

How to Fill W9 Form Online

When you are contracted by a business or a company and asked to fill in the W9 Form 2021, you’re not seen as a permanent employee even if you perform similar tasks and jobs as one. Differences between both might be fine, but in general, temporary employees are entitled to bigger control upon the way and time duration of their work. They are also able to save more when it comes to working expenses, say for working from home thus cut commute fees. That being said, these workers do not gain benefits like common full-time employees (for instance medical insurance or 401k employer match contribution).

Other times, you might be the party who has to send requests over W9 submission to the person you work with. It becomes your responsibility to collect W9 from the person you’re asking service from, then to keep a record over the document in case it’s asked by IRS – but you aren’t always obligated to send it to IRS.

Keeping documentation of the W9 form will ease your workload as a business owner when the tax due date comes. This document is actually so simple to fill out. It offers important information related to your employee in a neat way that’s easy to understand.

There are two methods to complete W9: on paper or through electronic means. If you are opting or requested to fill the form through an electronic system, you have to ensure that it can be produced in paper copy when being checked by the IRS.

The W9 form is the easiest to fill out when you perform the proper steps and go line by line. Here is a guide that might help you to complete this paperwork:

- First of all, you have to ensure that you are asked to fill the form for rightful reasons. Then prepare yourself to gather any necessary information needed within.

- Input your Employee Identification Number (EIN) if you are the employer or business owner who hires freelance or independent contractor resources. EIN also sometimes referred to as Federal Tax Identification Number (FTIN) or Federal Employer Identification Number (FEIN). It is a series of codes that contains 9 digits given by the IRS to classify the business type of a business entity in the USA.

- Input your full name, details of address, and identity number for the business you worked for if you are a freelancer or gig worker. Then confirm if you are currently a subject for backup withholding and any foreign assets.

How to Send and Submit W9 Form

There are different ways you can submit a W9 form. The first method, also the most secure and safest way is to send the paper copy of this document in person to the business that hires your resource. It is also possible to send it using courier services, but make sure you use reliable services such as UPS or FedEx in order to avoid unwanted situations such as the document being lost or sent to the wrong hands.

Another way to deliver the W9 form that has been filled in and signed in by using facsimile or e-mail. Again, as this document contains important personal information about you, you have to make sure that it is sent through trough electronic service with encrypted features.

W9 Form 2021

Loading...

Loading...