Table of Contents

W9 Form 2021 Printable PDF IRS – Being a self-employed person is not exactly an odd dream. Many people wish to be so, and you might have a real shot at it. It can be turned into reality once you have a solid plan and capital to start. However, you still have to remember there are some responsibilities when it comes to being self-employed – and one of them is to manage your own tax.

W9 is the form that lets self-employed persons handle their tax. Before you use it though, you have to ensure if you are indeed qualified to submit it.

Determine Your Entity First

Determining your business structure is one of the most essential things when it comes to beginning your self-employment journey. It is going to affect the flow of your taxable income through your tax return. Here are several different types of business entities that required filling W9 form.

- Sole proprietor

This is the simplest form of business that can be operated by a single person only. The term refers to someone who runs their own business carries personal responsibility for the business’ debts. If you are categorized under this category, you may report your own name or separate name to represent your business in the W9 form. - Corporation

Persons who build a business with partners are likely to be classified as corporations or partnerships. The business owner still has to fill W9 form even if they have filed an invoice to the organization they provide service for. This way, the organization is able to track payment and the government is able to make sure that the payment is considered as a business’ income. - C-corporation

It is a business structure in which the persons that run it are taxed separately from the business itself. The taxable income is counted on both personal and corporate levels. - S-corporation

Also commonly referred to as S-subchapter, the term S-corporation refers to an entity that has met requirements from the Internal Revenue Code. Unlike C-corporation, it gives benefit by not burdening the owner with double taxation.

There is also an LLC, which is technically is considered a legal business entity as well. However, in general, it is not recognized for federal tax purposes and instead has to file the form as a sole proprietorship, partnership, or corporation.

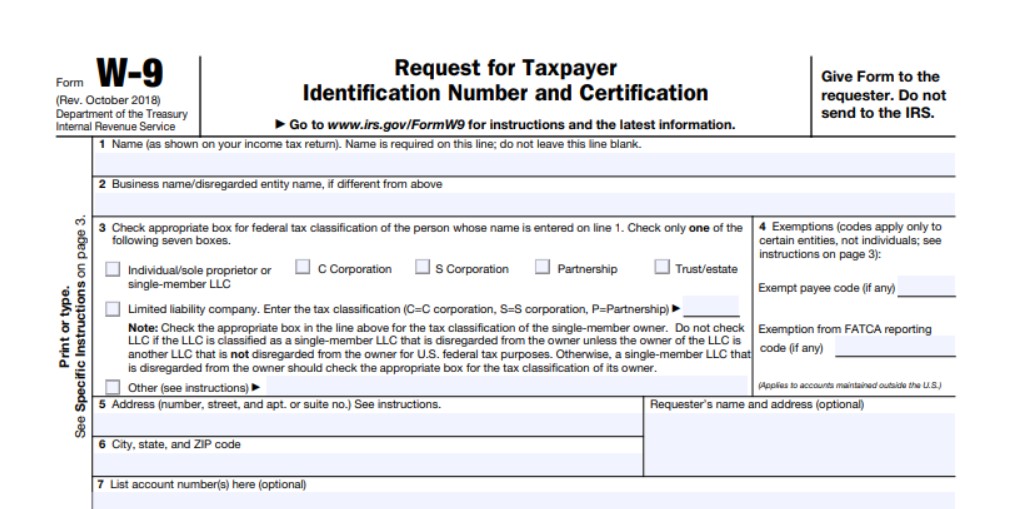

Guide to Fill W9 Form

The W9 form 2021 is an issued document by IRS that’s commonly used for tax purposes. Your employer may request you to submit it if you work as a self-employed person or have an independent business. That way, your employer is able to prepare the 1099 forms accurately during tax season.

You may download the form free online. In order to complete this document, follow these provided steps:

- Input the full name of yours in the first line within the form, which matches your other tax documents.

- Input your business name if you run it with a separate name than yours on the second line inside the form.

- Next, you have to choose your tax classification. Self-employed persons typically select the “Individual” or “Sole Proprietor” category in this section. Meanwhile, business persons who run corporations, estates, or partnerships should select their appropriate category accordingly.

- Input your detailed mailing address.

- By now you have completed a section. The next section is to input your Taxpayer Identification Number (TIN). In general, it means your Social Security number (for an individual), or assigned TIN (for resident alien), or EIN (for the business owner).

- Check the whole document for its data accuracy. Then put your signature and date at the bottom part of the W9 form.

The process of filling the W9 form is rather quick and simple. Now, all you have to do is to send the form back to the requester, so they are able to generate the 1099 form for their accounting purposes.

W9 Form 2021 Printable PDF IRS

Loading...

Loading...