Table of Contents

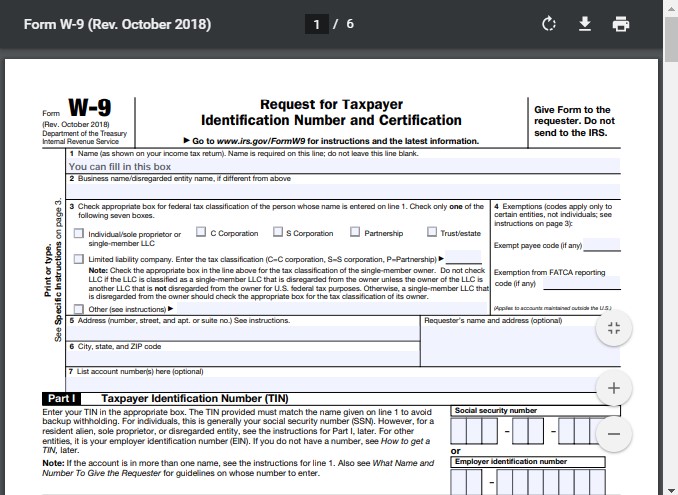

W9 Form 2021 Fillable – W9 is one of the many tax-related forms issued by the Internal Revenue Service (IRS). It serves exactly a sole function, which is to provide a Tax Identification Number (TIN). Now, despite the name, TIN isn’t actually comprised of the number itself. It is a term that’s used to cover Social Security Number (SSN) and employer identification number (EIN). After being filled with the correct information, W9 doesn’t have to be sent back to the IRS, but only to a person that needed your information contained inside. Learn more about this form below to help you fill it out.

What Is W9 Form 2021?

2021 W9 Form, also sometimes referred to as Request for Taxpayer Identification Number and Certification, is a single-page document used by businesses and individuals to provide their TIN number to another party that requested it.

Aside from the W9 main purpose mentioned above, it also serves as an informational document that allows IRS to know about the payment system inside a company or business. The employers or owners are obligated to report any paycheck worth $600 or more during tax season in 1099-MISC that submitted to IRS by the company.

In other words, if you’re an employee who’s qualified to fill W9 form in 2021, you have to send it to your employer instead of the IRS. Then your employer will keep the information and use them to submit another paperwork document to the IRS when they have to submit a tax return.

You are qualified to fill and submit this particular form to the person you are worked with if you are working on a part-time basis, as a freelancer, or providing services as an independent contractor. In other scenarios, such as you are being the person who’s requesting and using the services from these qualified types of person, then you have the responsibility to give them a request to fill the form and then keep it as a record.

Qualified Persons for W9 Form 2021

If your employer, service client, or financial institutions like a bank needs you to fill the W9 form, then they will send it out to you. In general, you don’t have to search for the document yourself. However, you may use the provided fillable W9 2021 form in case you need one.

Now, it has been explained who are qualified to fill and submit this form in prior points, but you can learn about it in more details by reading the following list of W9 qualified persons:

- The individual who works as a freelancer, contractor, or consultant for another entity that gets paid over $600 during one tax season. The entity, be it company or business, will need you to complete the document to fill and submit the 1099-MISC form as well as to report your income as an employee to IRS.

- The individual who invests in a financial institution. They need to submit either a W9 form or other 1099 types of forms because they are obligated to report income distributions, income interest, and to proceed with transactions related to real estate such as selling or buying a house.

- The individual who opens a new account at the bank, but it’s not always necessary.

- The individual who cancels or forgives other person’s debt, because they have to submit a 1099-C form to IRS, which requires information inside the W9 form inside to proceed.

- The individual who is not a US citizen but building a partnership with one. It is meant to prevent their US partners ’ shared income withholding and overcome supposition upon their foreign status.

Keep in mind that the only purpose of the W9 form in 2021 is to submit information for the employer’s record -which most times isn’t even checked by IRS. Your employer isn’t responsible to pay your Social Security, Medicare, and deduct your taxable income.

W9 Form 2021 Fillable

Loading...

Loading...