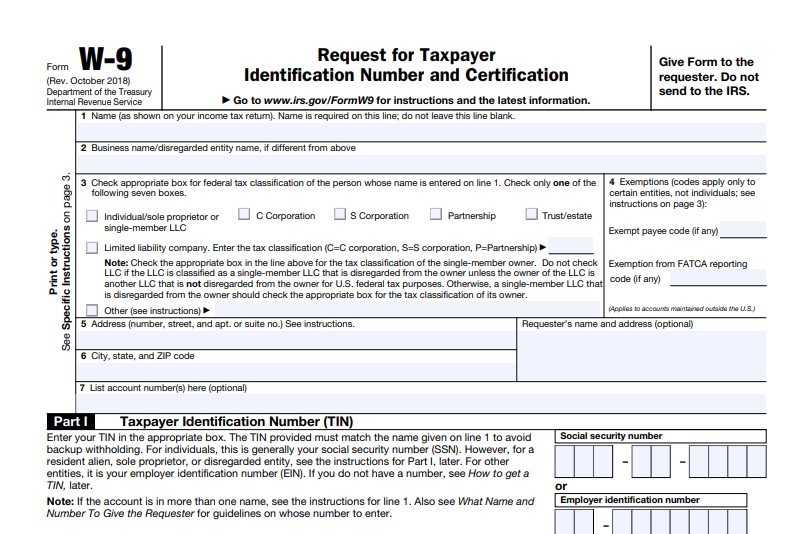

The W9 form 2021 is used in the United States income tax scheme by an outside party that must submit an income tax return with the Internal Revenue Service on behalf of a taxpayer. It requests personal data from a taxpayer, which includes personal income tax returns. The information submitted by a taxpayer for the W9 form is usually taken by an individual taxpayer and used by an outside agency for purposes not related to an individual taxpayer or not disclosed by an individual taxpayer to an outside agency. The taxpayer does not provide information that will be used to obtain information through other methods.

An individual taxpayer that is liable to pay tax withholdings and who has not been instructed to prepare an income tax return must submit his/her information in order to collect these withholdings. In fact, if the taxpayer has not been instructed to prepare an income tax return, he/she is not liable for withholding any tax. This is because most taxpayers have no obligation to file this form with the IRS and they do not have to comply with this form unless their return is due to the government on time.

A taxpayer filing W9 form must comply with many rules, regulations, and requirements, which can be found in the Internal Revenue Service. One requirement of this form is that a taxpayer must furnish all his/her social security numbers, driver’s license numbers, bank account numbers, and any other identifying information on a form of identification such as a passport. A taxpayer may submit only one form of identification at the time of filing a return. If a taxpayer is unsure about whether a social security number, driver’s license number, or any other identifying data is required for the W9 form, he/she may consult an accountant or tax preparer that is qualified to prepare this form.

A taxpayer may receive more than one W9 form for the year if he/she files an income tax return and a tax return at different times. The taxpayer may complete both forms at the same time, if the same income tax return was filed, however, it is not necessary to file two forms at the same time if an individual taxpayer is filing a joint tax return with one spouse. The W9 form is not a substitute for a written IRS tax return, but rather a supplement to it, for information such as personal information. And a copy of the returns filed by the individual taxpayer. Are considered public records and should be made available to anyone requesting them.

A taxpayer who uses an accounting service that is not certified to prepare a W9 form should inquire about the certification status of such services before they provide the taxpayer with such services. The process of preparing a W9 form is expensive, so it is best to ask for a refund calculator, not a refund calculator. These calculators allow the taxpayer to calculate the amount of taxes due to a variety of returns and then compare this amount to the number of tax deductions the taxpayer is entitled to take. The taxpayer must provide the amount of money left over at the end of the tax year, to cover the cost of the forms, plus interest charges, any applicable penalties, and the balance owed on the original tax return.

A taxpayer may also request that Form W9 be submitted electronically. However, the process of completing this form can be completed on paper as well, but it is easier to complete on paper. It is the taxpayer’s responsibility to ensure that he/she provides all the necessary personal information as required by the IRS and that any necessary paperwork is completed.