Table of Contents

2021 W9 Form Fill Out Online – Gathering tax-related information by using the W9 form manually can be quite complex because you have to ensure every single thing has been collected and all documents are tracked. The conventional approach of performing this task is by mailing a black copy of the W9 document one by one to the vendor, and attaching a request late to complete then send it back.

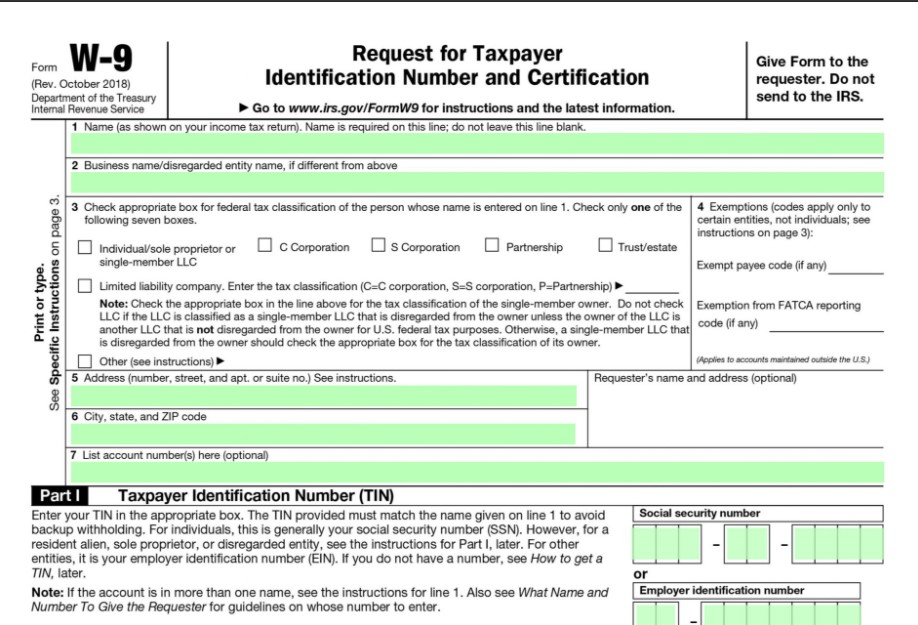

Form of W9 or Request for Taxpayer Identification Number and Certification is given when a company or employer-contracted freelance agent or independent contractor legally. Before the form is checked by the Internal Revenue Service (IRS) it has to be completed and verified with signature, which is possible to be done online. As the form is an essential part of contract-based work, it’s a good idea to learn how to perform it practically with the help of the internet.

How to Fill Online W9 Form Correctly

In this age, the human is considered to live in the digital world. Gone are the days where you need to print out a hard copy of the form and manually send them through mailing or facsimile services. The technology is getting advanced by the days, thus allowing you to complete the whole process of completing the W9 form online.

It is quite easy to find free trustworthy sources of W9 form on the internet that lets you fill it only by using your device. These sources provide help for any independent employee to send their personal information for tax purposes to the entity they work for. In order to do so, you have to input required information such as your name, address, and tax identification numbers. Then, the information is going to be used by your requester to produce their 1099-MISC form.

Online W9 form 2021 filling is also necessary if you change any of your inputted information within the document. Keep in mind that W9 is a document-based tool to collect information details from your employer, so they are able to complete the 1099 form during tax season. The details you provide inside will be kept by your employer for at least several years as a record, and not sent to IRS.

Here are the step by step processes to follow if you need to use the online W9 form to submit yours:

- First, find a reliable source to download the form, such as from the official website of the IRS or any of your preferable websites.

- Next, open the document on your computer by using an application to edit the PDF files.

- Fill each section one by one with correct information details to complete the form.

- Check the form double times to ensure that all your data are correct to use as a reference in the future.

- Upload the file or print them to the internet, to be sent to your employer.

How to Send Online W9 Form Safely

W9 form contains highly personal and sensitive information details, including your full name and identification number regarding tax. You want to avoid unwanted things happening such as identity theft, so don’t ever use unprotected e-mail. Free e-mail services are usually not secure and have the risk of being hacked.

That’s why you have to make sure to use a secure platform with end-to-end encryption when opting for an online solution. As extra prevention, you can protect the link you send with a password, then give the password by using a private phone call.

As an additional tip, you might use Employer Identification Number (EIN) instead of Social Security number (SSN). This is why it is generally recommended to provide your EIN, even if you submit W9 as a freelancer. You may consult tax professionals if you have any questionable situation.

2021 W9 Form Fill Out Online

Loading...

Loading...