Table of Contents

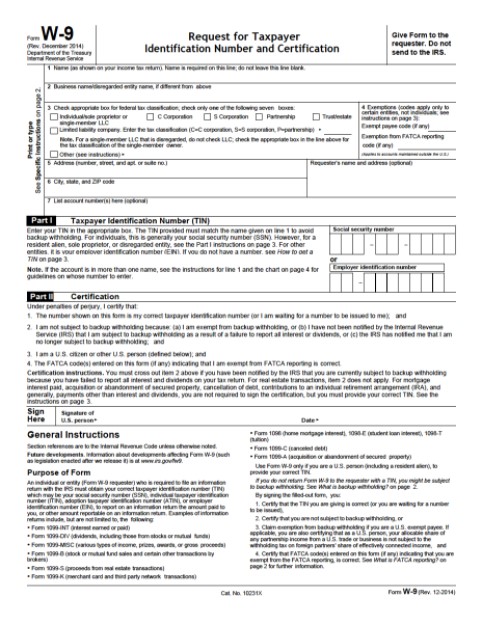

W9 2021 Form Printable – People who work in non-standard types of employment for the first time might have not fully understood yet what W9 form is. Sure, getting a job and clients are exciting, but you have to remember about the tax responsibility by filling the Request for Taxpayer Identification Number and Certification before receiving payment. Now, you can learn more about the document in an easily understandable way. It’s also worth informing that, luckily W9 form is actually not as complex as other tax forms issued by IRS.

When to Submit W9 Form

Before you learn about what the W9 form 2021 is about, it’s better to understand the 1099-MISC form first. The 1099 form is a document used by the IRS to ensure that people report their income properly and correctly, by comparing and cross-checking the reported tax returns to the clients’ 1099 form.

Businesses that apply some forms of non-standard employment and pay $600 or more for the services are obligated to report their expenses in 1099 form. In order to fill and submit this particular form, they will need the service provider to hand in personal details, including tax identity number. So, the purpose of filling the W9 form is simply to present accurate information in order to prepare the 1099 form submission.

You are demanded to fill, complete, and submit the W9 form if you are:

- Getting started on a new job and asked to hand one by your employer. You may take it as an indication that the business meant to use your service as an independent source rather than consider you as a permanent employee because fixed employees have to fill W4 forms instead of a W9. Thus, your employer won’t withhold taxes from your income.

- Getting your information changed such as changing your full name or address. In this case, you have to update the form. The form has to be updated as well if your business’ name, structure, or EIN is modified.

If you are included in either of the scenarios above, then you have to ask or download a W9 blank document, then fill it, and send it to the requester.

What Happens If You Fail to Submit W9 Form

It is always better to request your employee or service providers to fill W9 form before you give them their payment. After all, you only have to simply download the document from the IRS official website or any trusted internet sources, then request them to complete and send back the document. You aren’t obligated to send the form back to IRS, but only to store it as documentation and use it when you have to submit the 1099 form during tax season.

You might wonder, what can possibly happen if you fail to request the W9 form and don’t have access to your employee’s SSN or EIN. In this type of case, you have to keep a record of your multiple requests upon the employee’s TIN. After that, inform clearly inside your submitted 1099 form that the employee has refused to hand out their tax-related information.

It is possible that you will be penalized for not being able to provide the demanded information within the 1099 form, but at least the penalty might be reduced if you have proof of the multiple attempts of TIN request from your employee. Then, when you give future payment to the said employee, you have to perform 28% backup withholding immediately and forward it to IRS.

Payment is an important part of any business and job. As an employee, it is your responsibility to provide a W9 form. Now that you have a better understanding of this particular tax document, completing one should be an easy task for you. You can receive your payment without any tax burden after you submit the form, which is all the business is about.

W9 2021 Form Printable

Loading...

Loading...