Table of Contents

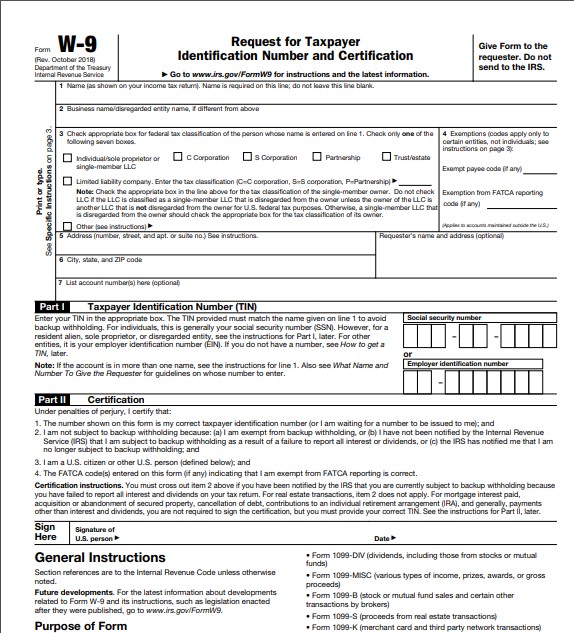

IRS W9 Form 2021 Printable – The W9 Form 2021 is a document filled out and handed by freelancers and independent contractors to provide information that submitted to the Internal Revenue Service (IRS). The information inside is comprised of full, name, address, and Taxpayer Identification Number (TIN) in either Employee Identification Number (EIN). Or Social Security Number (SSN).

Besides persons with professions above, those who gained interest or dividends from financial institutions, or earned any other types of payment including incentive or cash gifts. You may read about it further in the following passage.

When Do You Need W9 Form

As mentioned above, the W9 form is requested by an entity that uses a freelance agent or independent contractor. It is not always, even rare to be sent back to the IRS, but it sometimes is. It mostly used as a record for verification purposes during 1099 form submission by the said entity.

The official name of the W9 form is Request for Taxpayer Identification and Certification. Just like other government-issued documents, it also serves a special purpose regarding tax. Here several circumstances in which one is required to fill in the form:

1. Having a business agreement of freelance or contractor services

A business or company that makes payments in the amount of $600 or more is obligated to fill the 1099-MISC form, which needs information about the person who provides service to the said business. The information is including full name, address details, and tax identification number (TIN).

2. Having agreements of part-time employment

Typically, any information related to part-time employment such as payment, contract time duration, and work hours are provided in W2 and W4 forms. However, in order to complete the 1099 document, the employer still requires a W9 form and ask their employee to submit one.

3. Having a professional agreement between the customer and financial institution

W9 is also commonly used by financial institutions to keep records of their customer’s identities when they are about to open a new account in the said institution. It is not always necessary to use the W9 form, but it is a useful form to have to keep important information about customers.

4. Having an agreement regarding real estate

There are companies that engage in the business of real estate that ask their tenants to hand W9 form. It is mostly used as a record of essential information instead of a requirement to secure a rental contract.

5. Preventing backup withholding

IRS usually makes sure that it gathers tax from business’ or investor’s taxable income prior to tax bill due dates by using backup withholding. It is normally applied if the businesses haven’t complied with TIN related regulations.

To avoid this backup withholding situation, the payee will use W9. This form shows certification that the payees are not liable to backup withholding. Thus, they are entitled to receive unreduced payment from employers or payers. For employees or payees, it has a somehow similar purpose to withholding exemption certification.

Differences between W9 and Other Related Forms

The W9 form is different from the 1099 document. W9 is typically utilized to record information about freelancers or contractors for businesses that use their service, but the form itself doesn’t have to be sent to IRS. 1099 form on the other hand is submitted to IRS as gross income record during tax season.

This form is different from the W4 form as well. W4 is typically filled out by full-time employees which means they work permanently for the employer. It is possible for employers to request W9 from their permanent workers if they received other payments besides regular salaries such as incentives, gifts, or vouchers.

W9 document is meant for people who are responsible for their own tax returns. If you’re a permanent worker who works full time and is asked to submit this form, ask for confirmation from your employer whether you are actually considered as a fixed employee or temporary substation.

IRS W9 Form 2021 Printable

Loading...

Loading...