Table of Contents

2021 W9 Forms Printable – Any person who provides services or business entity that hires services with payment value at $600 and higher needs to report the transaction for tax purposes Internal Revenue Service (IRS). The purpose is to present their correct tax identification numbers. To complete this process, they may request or send a request of W9 form submission, which is issued by the IRS as well.

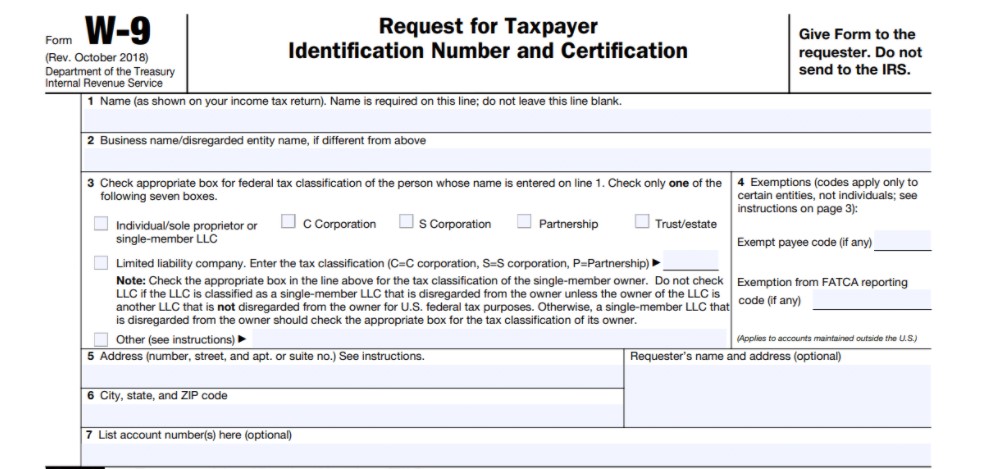

Being more formally referred to as Request for Taxpayer Identification Number and Certification, the W9 form is a simple single-page document that contains personal information of taxpayers, their tax exemptions (if any), and signature as certification. Sometimes, a copy of this form is sent alongside instructions.

W9 Form, Request for Taxpayer Identification Number and Certification

W9 might be requested from the business or individual that conducted employment with an independent contractor or freelancer, as well as domestic or estate-related trust. The contracted individual employee must pose U.S citizenship or legal residential status, or based in United State if they’re a business company. Otherwise, they must submit the W8 form instead.

To get W9 submission, the form must be sent to the employee that provides the service. Where to get the blank copy of this form? You might download it for free from the official site of IRS or you may download it from other resources online – but make sure you get a document with the same details such as the official one issued by IRS or you can download it here on our website. After that, the form can be either manually mailed or e-mailed to the requester.

W9 Form Validity Period

Every single valid W9 form 2021 must include accurate information details, including the taxpayer’s name, their address, their tax identity number, their classification of federal tax, and other relevant inputs such as backup withholding tax or certification number. The employer then uses the information to report transactions with the employed persons when they generate income tax returns. Therefore, the form doesn’t have to be submitted to the IRS but documented for the employer’s future use.

Here are the details of the W9 form’s validity period to be used by the employer:

- Signed Date

The form is valid by the time it is signed, according to the date within the document, with approval upon the substance including tax exemption. For example, if the IRS W9 document is verified with signature by the eligible employee during the middle of their contract, the form will be valid to use for the whole period of payment. The tax exemption is not related to the payment period before submission, so the employee won’t be granted a tax refund. If there is any valid tax withholding and supporting documents before the form is submitted, then the information must be reported during the tax season in the statements. - Annual period

The signed W9 document is valid for the entire current year. Thus, if the employee wishes to claim an exemption for their income tax for the next year on December 31, they must fill in and submit a new form and context in a statement for the next annual period. In case the new W9 form and its explaining statement are not sent until the beginning of the payment period of the next annual period, then they are obligated to pay income tax until they submit another form. - Information changes

If the employee goes through any information details changes that are relevant to the form, they must notify the employer and information about the modification.

If you work as a contractor, consultant, freelancer, self-employed worker, or other types of employment in the same vein, then there is a great possibility that you will encounter a W9 form. The entity that uses your service might request you to complete the W9 form and provide a blank copy for you, but you can always use the free online form via the internet.

2021 W9 Forms Printable

Loading...

Loading...