Table of Contents

2021 Blank W9 Form – People who work as a permanent or full-time worker have their tax covered and automatically withheld by the employer. However, it is not the same case for non-standard forms of employment. Employees under this category have to manage their taxes. If you run a business that has been outsourcing employees temporarily, then you’ve probably have dealt with the W9 form before.

The Meaning of Different Terms inside W9 Form

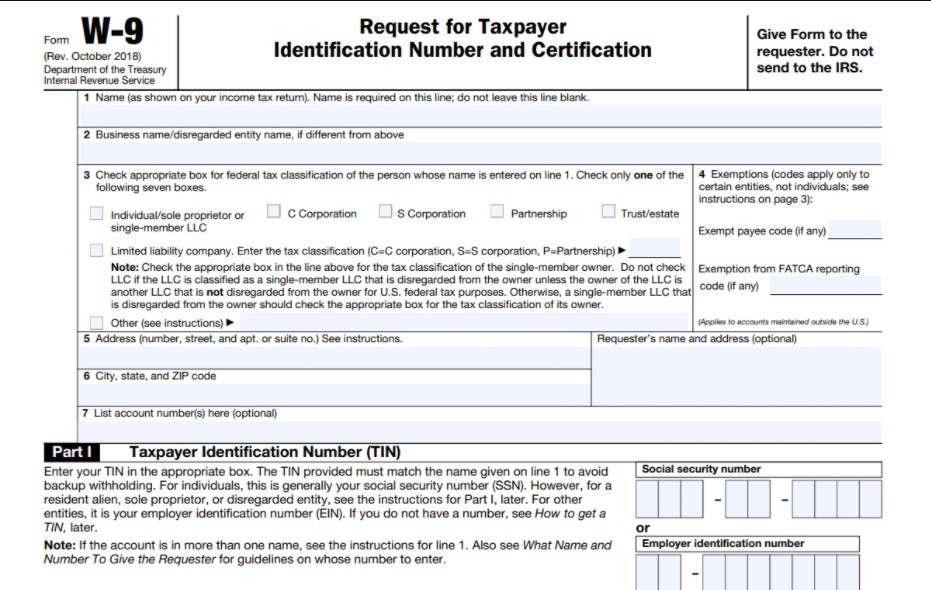

W9 Form 2021 is a form used by taxpayers to provide their taxpayer identification number (TIN) and to verify that they indeed are not imposed to backup withholding. Also known as Request for Taxpayer Identification Number and Certification officially, this form is usually utilized if the taxpayers require someone to report a particular type of their income.

The form comprised of various information such as name, address, tax identity number, as well as social security number. W9 is actually not required to be sent to the IRS back; despite the agency is the one that issued it. Instead, it is kept as a reference for the employer when they file tax returns.

If it is your first time to fill and submit this document, you might not be familiar with the common terminologies used within. Read the explanation below about several terms that used inside the W9 form.

- Taxpayer Identification Number (TIN): TIN is essentially the Social Security Number (SSN) for people who have one. However, if the tax subjected entity doesn’t have SSN such as a business company, then it must be filled with an Employer Identification Number (EIN).

- Backup Withholding: It is a portion of your income that is held from your payment, and being submitted to the IRS instead. It is a condition that may happen if you don’t meet requirements for TIN as a taxpayer or if you don’t report to IRS about your income correctly.

- Exemptions: It is the part of the W9 document that applies to particular entities aside from individuals. If your entity is granted a backup withholding exemption, then you have to input the suitable code according to the IRS instructions.

Guide to Fill Out W9 Form Correctly

In general, it is not hard at all to fill W9 form, because it is a simple document. However, you have to make sure to fill it correctly. Here is a helpful guide you might use to fill out the paperwork:

- Input your full name to the provided field. Remember that the spelling of your name must be matched precisely with the other tax-related documents submitted to IRS.

- Input your business name in the respective field. If you do not have a business, simply leave it blank.

- The next step is to input your tax status according to the provided classification. The choices of the category are comprised of individual, single-member Limited Liability Companies (LLC), or sole proprietor. There are also other category options such as partnership, estate business, S corporation, or C corporation.

- Input residential data or your full address yours. It must be filled in detail with house number or apartment unit number, and street name included.

- Input your TIN number, which could be either Employer Identification Number (EIN) or Social Security Number (SSN). The later identity number is used if you fill the form as a party who’s being employed.

- Finally, sign the document above your name and under the date. The signature serves as verification that you have inputted correct data inside the form.

The guide above may help you to understand the W9 form better, especially as the tax season of 2020 is slowly approaching. You may need or not need to fill the document – depending on your current situation of employment, but it’s always better to know more, so you already prepared when you are required to.

2021 Blank W9 Form

Loading...

Loading...